What’s the Property tax problem?

- Real estate taxation systems are not technologically controlled, that is, are fed with uncontrolled information.

- An incorrect address can be entered, Incorrect ID no, incorrect property area, incorrect use, and the system does not have error logs.

What is the solution?

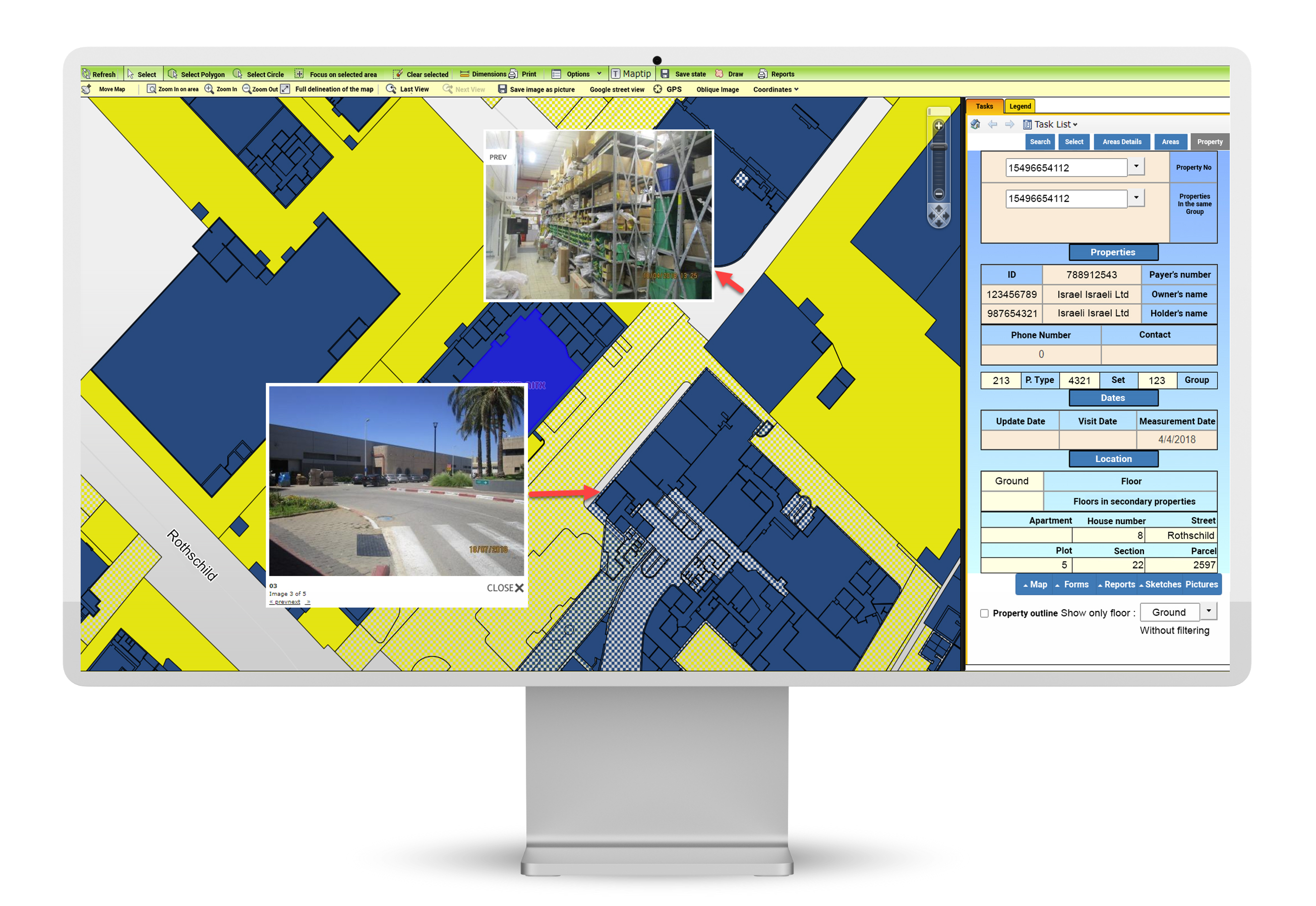

- Property tax Management based on GIS (Geographic Information Systems) technology.

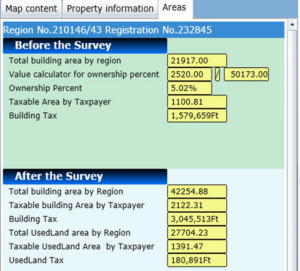

- The solution purpose – to maximize the government self-income from property taxes, without changing the law or make tax rates more expensive.

- The project financing will can be applied on Orhitec, and can be based on a success fee, from the additional income, without imposing new taxes.

- The tax rules will be subject to the state and local government laws.

- The existing governmental incomes will be secure in advance.

- The entire project will be done as a turnkey project under the government supervision.

- The taxes will be based on reliable information, which will have the effect of easing the process of tax collection.

- The political echelon will be freed from public pressure.

- The project will supply employment for the local public.

- The revenue management will be based on all update relevant information.

- The information will be updated easily as part of a routine.

Experience and years of seniority:

- Orhitec GIS Ltd was founded in 1999 and has experience in installing the solution in more than 130 different authorities in Israel, Europe and around the world.

The project 3 miles stones:

- Pilot project based on the client answers to the professional questioner.

- According to the pilot project results, establishment of common business plan based on a 5–10-year agreement.

- Characterizing a system in accordance with state laws, establishing the Property tax system based on GIS technology.

Local supply – The entire work will be done locally.

Property Tax Management based on GIS technology provides the advantages as follows, achieving only by GIS:

- Increase the income from property tax by enabling the Government\Municipality to constantly monitor properties and locate building and additions to buildings that are not currently on the tax records.

- Errors in taxation have occurred by cross-referencing field maps and field data.

- Reinforcing credibility of the municipality with the residents, and elevating the quality of service available to the residents because problems are discovered before tax statements are sent out to the residents.

- Lessens the need for appeals and reversals of tax assessments by conducting the survey professionally.

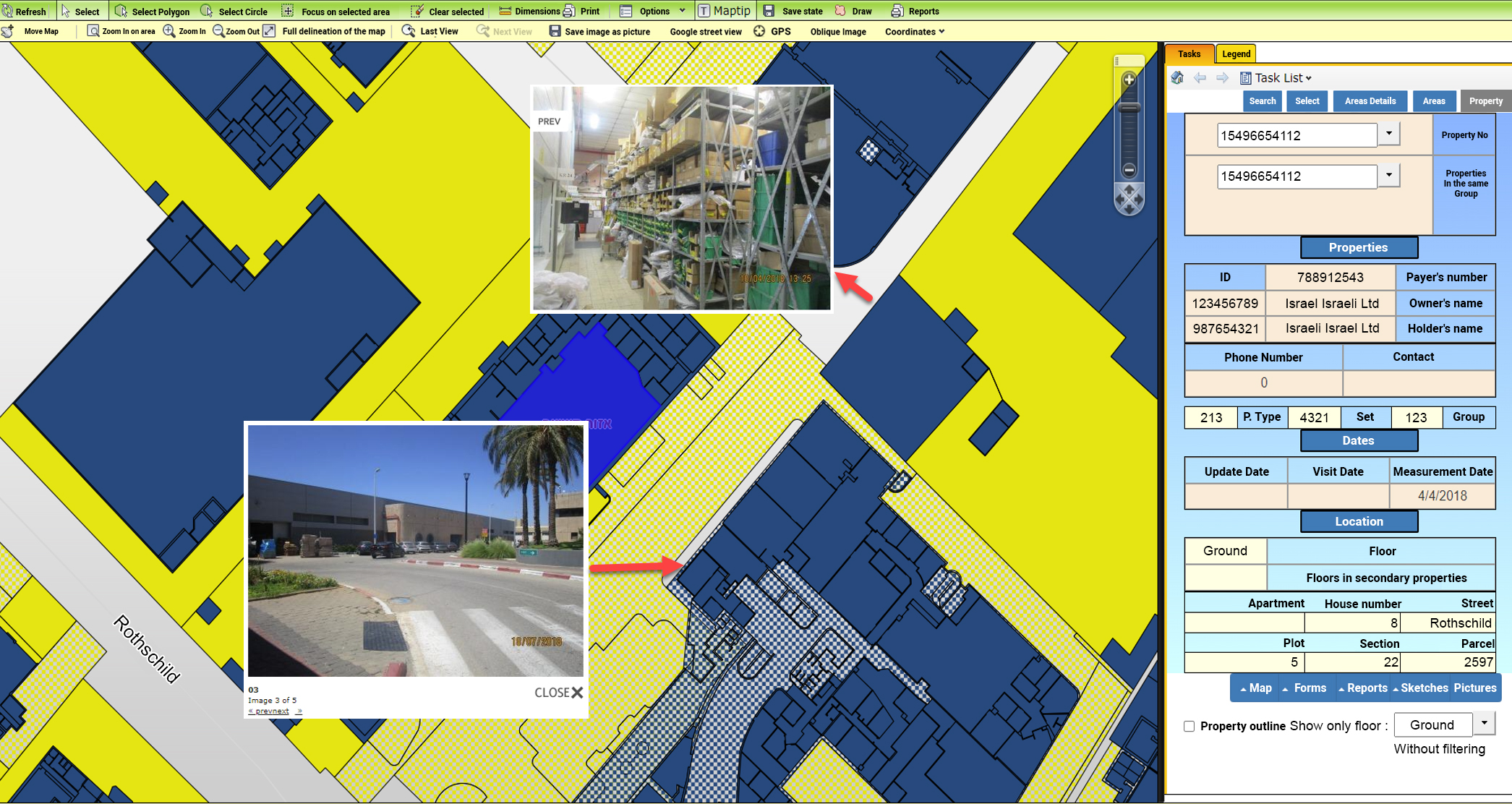

- GIS enables properties to be viewed on the aerial photograph (Orthophoto) or from the side if photographed in the field. This makes it much easier to verify information without bothering the resident.

- Lessens the need for appeals and reversals of tax assessments by conducting the survey professionally.

- Wide and varied use of property tax data for engineering needs cannot be done without geographic data.

- All of the above advantages translate into significant financial savings to the municipality and greatly improved service to the residents.

- Orhitec Solution can work interactively with municipal tax collection departments.

- Revenue management will maximize the income from municipal taxes after adapting the GIS system to the local laws of property and real estate taxes.

- The political echelon will be freed from public pressure.

- This makes it much easier to verify information without bothering the resident.

- The GIS System will also be used for other public services, such as: legal needs for lawyers and evidence, Town planning, Property management, land registry, land use, Building violation control, infrastructure management and maintenance, Security, e-government public domain information, Academic researchers, economics, and more.

- The tax information will be accessible to the public by information service offices from the government offices, and over the Internet.

Technology:

- Our GIS applications are based on universal platforms like Autodesk & ESRI software, and the databases of Microsoft.

- An extensive set of stand-alone applications for data collection, data checking (quality control), data management, and many others.

- The user interface is customizable for various users, Internet and intranet, depending on the level of access to sensitive information.

- Our development department can provide a user interface in any language required by the client.

- All our applications can interface with existing programs such as billing applications, Property management, Land registration, Control, and monitoring systems, etc.

- Our systems are supplied as turnkey applications and can include hardware solutions, outsourcing to professional personnel, help desk, and others.

- User support and training for the GIS products to various clients.

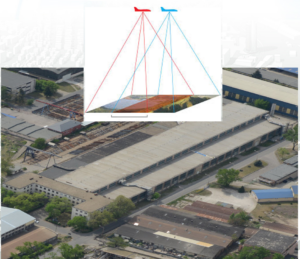

The use of 3D orthophotos and maps for property tax:

Apps for a supervisor’s or geographic surveyor on a PC tablet and Smart phone:

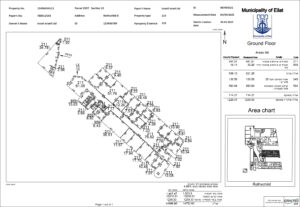

- Geographic information is collected in the field by surveyors who measure properties dimensions, and data information which describes the property.

- The properties are positioned geographically using either Photogrammetric maps or aerial photographs (Orthophotos).

- The base information thus collected is exactly the same as the base information used by the city engineering department (for example: property areas, property use, address, property owner, identity number, etc.).

In this way, a single base of information can be used by many municipal departments without the need to duplicate any information.